Explore Punta Mita

A

KUPURI ESTATES

Overlooking Litibu Bay on the north-facing side of Punta Mita, this intimate and secluded community offers...

Read More

Overlooking Litibu Bay on the north-facing side of Punta Mita, this intimate and secluded community offers...

Read More

B

IYARI ESTATES & VILLAS

The word Iyari means “spiritual heart” (heart/soul) in the Huichol language, and speaks to the location of…

Read More

The word Iyari means “spiritual heart” (heart/soul) in the Huichol language, and speaks to the location of…

Read More

C

FOUR SEASONS PRIVATE VILLAS AND RESIDENCES

Comprised of various enclaves that “stair step” down a hillside, the villas...

Read More

Comprised of various enclaves that “stair step” down a hillside, the villas...

Read More

E

LAS PALMAS

Situated between the second, third and fourth fairways of the Jack Nicklaus Pacifico Signature golf course, Las Palmas...

Read More

Situated between the second, third and fourth fairways of the Jack Nicklaus Pacifico Signature golf course, Las Palmas...

Read More

G

LAS MARIETAS

Las Marietas - an elite enclave of 42 residences named for the incredible views of the Marietas Islands - are located just...

Read More

Las Marietas - an elite enclave of 42 residences named for the incredible views of the Marietas Islands - are located just...

Read More

H

LA PUNTA ESTATES

La Punta Estates offers thirty one spectacular oceanfront estate lots, each at least one acre size, some...

Read More

La Punta Estates offers thirty one spectacular oceanfront estate lots, each at least one acre size, some...

Read More

I

PORTA FORTUNA

Porta Fortuna luxury homes blend contemporary Mexican architecture with modern finishes and state of the art...

Read More

Porta Fortuna luxury homes blend contemporary Mexican architecture with modern finishes and state of the art...

Read More

J

EL ENCANTO

Designed to blend effortlessly with the Punta Mita landscape, the residences in the deluxe gated El Encanto...

Read More

Designed to blend effortlessly with the Punta Mita landscape, the residences in the deluxe gated El Encanto...

Read More

K

LAGOS DEL MAR

With unencumbered Banderas Bay views from one room and looking out across the Jack Nicklaus Signature golf...

Read More

With unencumbered Banderas Bay views from one room and looking out across the Jack Nicklaus Signature golf...

Read More

L

LAS TERRAZAS

Las Terrazas is a 27 unit boutique condominium property located in the heart of Punta Mita on the 14th fairway...

Read More

Las Terrazas is a 27 unit boutique condominium property located in the heart of Punta Mita on the 14th fairway...

Read More

M

LA SERENATA

La Serenata is an elegant development of six exclusive villas located on the 7th fairway of Jack Nicklaus...

Read More

La Serenata is an elegant development of six exclusive villas located on the 7th fairway of Jack Nicklaus...

Read More

N

HACIENDA DE MITA

Set within a pristine location, this extraordinary community is a gated enclave of condominium residences in...

Read More

Set within a pristine location, this extraordinary community is a gated enclave of condominium residences in...

Read More

O

RANCHOS ESTATES

With a distinct beachfront location on Banderas Bay, these signature estates average over an acre in size and are...

Read More

With a distinct beachfront location on Banderas Bay, these signature estates average over an acre in size and are...

Read More

P

SIGNATURE ESTATES

Situated along the most serene, widest and perhaps most picturesque of Punta Mita's white sand beaches, these...

Read More

Situated along the most serene, widest and perhaps most picturesque of Punta Mita's white sand beaches, these...

Read More

Q

PACIFICO ESTATES

These spectacular oceanfront estate lots, for single-family residential use, offer one of Punta Mita’s premier locations…

Read More

These spectacular oceanfront estate lots, for single-family residential use, offer one of Punta Mita’s premier locations…

Read More

R

TAU RESIDENCES

With an enviable location nestled between the Pacific Ocean and Banderas Bay on the southern point of the Punta Mita ...

Read More

With an enviable location nestled between the Pacific Ocean and Banderas Bay on the southern point of the Punta Mita ...

Read More

S

BAHIA SIGNATURE ESTATES

Bahia Signature Estates, offering a rare opportunity to own breathtaking beachfront property in this world-renowned...

Read More

Bahia Signature Estates, offering a rare opportunity to own breathtaking beachfront property in this world-renowned...

Read More

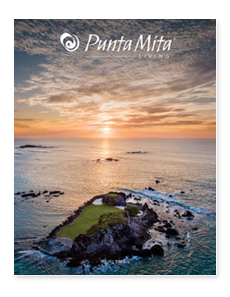

Punta Mita Living Magazine

Welcome to the official magazine of Club Punta Mita. Within these pages you’ll find stories about life in and around Punta Mita. From in-depth interviews with local personalities to updates on new business openings, real estate development, area attractions, events and more.

We hope you enjoy every issue of Punta Mita Living and invite you to “Live the Dream” that we call Punta Mita.